LiteFinance Turkey

LiteFinance is a prominent forex broker based in Turkey, providing its clients with access to the international foreign exchange market. It offers a wide range of services including trading in currencies, commodities, and indices. This broker is known for its advanced trading platforms, competitive spreads, and commitment to transparency and security. LiteFinance also prioritizes customer support, offering 24/7 assistance to its clients. With its user-friendly interface and educational resources, it’s an ideal choice for both beginners and experienced traders in the forex market. In this LiteFinance review in Turkey, we will learn more about the forex broker’s features, advantages, and more.

LiteFinance Account Types

LiteFinance forex broker offers various account types to cater to the needs of different kinds of traders. These account types are:

- The ECN account is perfect for traders who prefer a low deposit amount to kickstart their trading journey. The minimum deposit for an ECN account is only $50. This account type offers increased quoting precision and market execution without requotes, which is crucial for traders who want to avoid the risk of slippage. The leverage ratio is quite high at 1:1000, allowing traders to maximize their profits. The account also offers low floating spreads and allows for scalping and news trading. There are no stop and limit levels, which provides traders with the flexibility to set their own risk and profit targets. An added advantage of the ECN account is the availability of a copy trading platform, which allows less experienced traders to replicate the trades of successful investors. Importantly, the ECN account ensures there are no conflicts of interest.

- The Classic account, like the ECN account, also requires a minimum deposit of $50. The leverage ratio is the same at 1:1000. Traders can choose from a wide range of trading platforms including MT4/MT5, depending on their preference and comfort level. Similar to the ECN account, the Classic account also offers market execution without requotes and increased quoting precision. There are no stop and limit levels in this account type either.

- Lastly, the Cent account is ideal for beginners or those with limited capital. The minimum deposit is only $10, making it the most affordable option. The Cent account provides traders with the opportunity to trade in micro lots, which can be a great way to learn and practice trading strategies without risking too much. The contract size in this account is only $1000, which means traders can open positions with a smaller amount of capital. Despite its low deposit requirement, the Cent account doesn’t compromise on the trading experience and still offers the benefits of the other account types.

Each account type offered by LiteFinance has its unique features and benefits, allowing traders to choose the account type that best fits their trading style and needs.

LiteFinance Demo Account

This account type is a risk-free trading account where you can practice trading without using real money. It’s an excellent resource for beginners to familiarize themselves with the trading platform and for experienced traders to test their trading strategies.

LiteFinance Islamic Account

Also known as a swap-free account. It is designed for traders who cannot earn or pay interest due to their religious beliefs. A swap-free account does not charge or pay swap or rollover interest on positions that are held overnight, which complies with the Islamic Sharia Law.

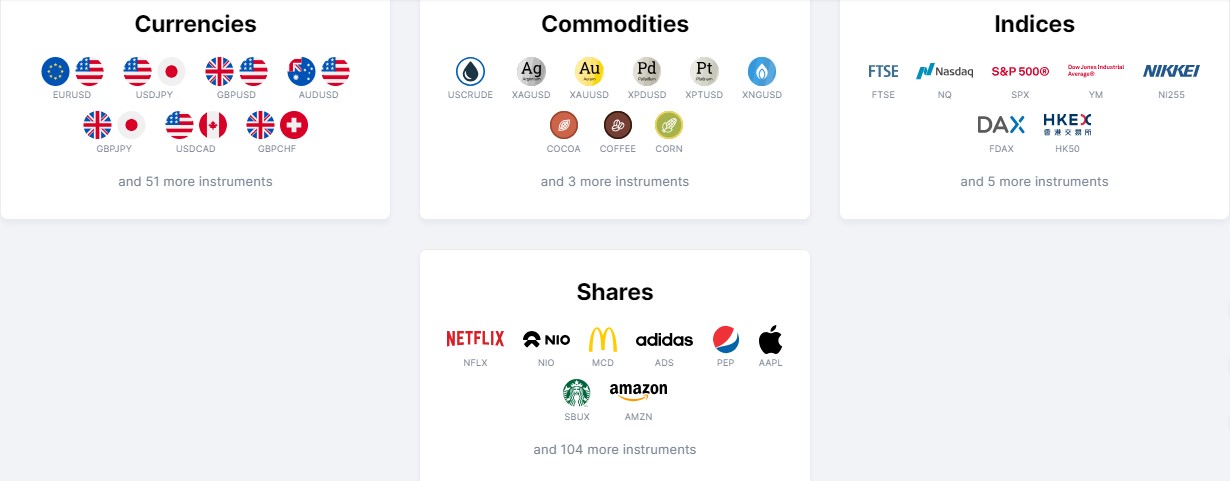

Financial Instruments Available with Litefinance

LiteFinance broker offers a wide range of financial assets for trading. These assets are available in various markets and regions, including Turkey. Here’s a detailed list of the available financial assets you can trade with LiteFinance:

- Currency: This asset involves trading with the Turkish Lira, which is the official currency of Turkey. The value of this currency fluctuates based on economic conditions in Turkey and globally.

- Commodities: This is a broad category that includes physical assets like gold, silver, oil, natural gas, and agricultural products. The prices of these commodities are driven by supply and demand dynamics in global markets.

- Global Stock Indices CFD: CFDs (Contract for Difference) on global stock indices allow traders to speculate on the price movements of entire stock markets, like the S&P 500, Dow Jones, FTSE 100, DAX, and others, without owning the actual stocks.

- NYSE CFD: Traders can speculate on the price movements of stocks listed on the New York Stock Exchange (NYSE), one of the world’s largest stock exchanges.

- NASDAQ CFD: This involves trading Contracts for Difference on the NASDAQ Exchange, which is home to many of the world’s largest technology companies.

- EURONEXT CFD: Euronext is the largest stock exchange in Europe. CFD trading here means you can speculate on the price movements of its listed stocks without owning them.

- LONDON LSE CFD: The London Stock Exchange (LSE) is one of the oldest and largest stock exchanges in the world. LSE CFDs offer traders opportunities to profit from the price movements of stocks listed on the LSE.

- XETRA CFD: Xetra is an all-electronic trading system based in Frankfurt, Germany. Xetra CFDs allow traders to speculate on the price movements of the German stock market.

LiteFinance Deposit Options in Turkey

LiteFinance is a platform that allows users to manage their finances. For users in Turkey, there are several deposit options available to them.

- Bank Transfers: Users can deposit money into their LiteFinance account through bank transfers. This is typically done through online banking, where the user can transfer funds from their bank account directly to their LiteFinance account. This is a convenient option for users who want to manage their finances without having to physically go to the bank.

- Credit/Debit Cards: Another deposit option for LiteFinance users in Turkey is through credit or debit cards. This is a quick and convenient way to deposit money, as it can be done anywhere and at any time. Users simply need to provide their card details and the amount they wish to deposit.

- E-Wallets: E-wallets are another deposit option for LiteFinance users in Turkey. This digital payment method allows users to deposit money into their LiteFinance account from their e-wallet. This is a convenient and secure deposit option, as it does not require users to share their bank or card details.

These deposit options provide LiteFinance users in Turkey with the flexibility to manage their finances in a way that suits them best. Whether they prefer the traditional method of bank transfers, the convenience of credit/debit cards, or the security of e-wallets, there is a deposit option to suit every user’s needs. The LiteFinance minimum deposit amount depends on the account type.

LiteFinance Withdrawal Options in Turkey

LiteFinance offers its clients in Turkey a variety of options for withdrawing their funds. These methods are designed to provide the maximum convenience and ease for users, ensuring a smooth and efficient transaction process.

- Credit/Debit Cards: LiteFinance allows its clients to use their credit or debit cards for withdrawals. It is a quick and convenient method, as most people usually have access to a bank card. The process is simple and the transactions are secure. It’s important to note that the name on the card must match the name on the LiteFinance trading account.

- Bank Transfers: Another withdrawal option offered by LiteFinance is bank transfers. This option is typically used for larger transaction amounts. While it might take a bit longer compared to card withdrawals due to processing times set by banks, this method is a reliable and secure way to withdraw your funds directly to your bank account.

- E-Wallets: LiteFinance also accommodates withdrawals through various e-wallet systems. These digital platforms are becoming increasingly popular due to their convenience and fast transaction times. Users can easily manage and transfer their funds using services like PayPal, Skrill, or Neteller, among others.

As for the LiteFinance minimum withdrawal amount, the platform has set guidelines to ensure the smooth processing of transactions. However, the specific amount may vary depending on the withdrawal method chosen. It’s recommended that users check these details on the LiteFinance platform or reach out to their support team for accurate information.

Remember, it’s crucial to verify your account and complete all necessary KYC procedures before making a withdrawal to ensure a smooth and secure transaction process.

Trading Platforms

LiteFinance provides various trading platforms for its users to cater to their different trading needs. This includes:

- LiteFinance MT4 (MetaTrader 4): MetaTrader 4 is one of the most popular trading platforms available. It offers a user-friendly interface that is easy to navigate, even for beginners. MT4 provides live quotes, real-time charts, in-depth news, and analytics, as well as a host of order management tools, indicators, and expert advisors. It’s an ideal platform for those who want to trade Forex, CFDs, and other financial instruments.

- LiteFinance MT5 (MetaTrader 5): MetaTrader 5 is a more advanced trading platform compared to MT4. It provides additional features such as more timeframes, more technical analysis tools, and the ability to trade stocks and futures. It also supports automated trading through the use of robots and signals.

- cTrader: cTrader is another platform provided by LiteFinance. It’s known for its speedy execution of trades and its advanced charting tools. It also offers level II pricing, a feature that allows traders to view the full range of executable prices coming directly from liquidity providers.

- LiteFinance Mobile Apps: Recognizing the need for on-the-go trading, LiteFinance also offers mobile applications. These apps allow traders to manage their accounts, monitor the market, and perform trades right from their smartphones or tablets. The mobile apps are designed to be intuitive and easy-to-use, ensuring that traders can trade effectively, even when they are away from their computers.

Trader’s Tools

- Economic Calendar: This tool helps traders to track economic events that might affect their trading. It includes information such as the time and date of the event, the country that it is relevant to, the importance of the event, previous data related to the event, and forecasts.

- Analytics: This tool provides traders with an analysis of the market, including trends and patterns that might influence trading decisions. It can include both technical and fundamental analysis.

- Analytical Materials from Claws&Horns: Claws & Horns provides independent analytical services. These could include market reviews, economic news, analysis of investment opportunities, and recommendations.

- Trader’s Calculator: This tool allows traders to calculate potential profit or loss before making a trade. It can also be used to determine the margin requirements for a particular trade.

- Fibonacci Calculator: This tool is used to calculate potential support and resistance levels based on the Fibonacci retracement levels. It is commonly used in technical analysis to predict potential price movements.

- Currency Rates: This tool provides up-to-date information on the exchange rates of various currencies. It is essential for forex traders who need to know the current value of the currencies they are trading.

- Economics News: This tool provides traders with the latest news related to the economy. It can include information on interest rates, unemployment rates, GDP growth, inflation, and other economic indicators that might affect trading.

Forex Social Trading – LiteFinance Copy Trading System

LiteFinance Forex Social Trading introduces its innovative Copy Trading System which enables traders to copy the trading strategies of experienced forex traders. This system not only simplifies forex trading for beginners by eliminating the need for in-depth market analysis but also allows them to learn from the experts in real-time. By leveraging the expertise of successful traders, users can potentially increase their profitability while minimizing risks. LiteFinance’s Copy Trading system effectively bridges the gap between novice and experienced traders, fostering a collaborative trading environment within the forex market.

LiteFinance Turkey Additional Services

LiteFinance forex broker is a financial services company that offers a variety of additional services to cater to the diverse needs of its customers.

- Autowithdrawal: This service allows clients to set up automatic withdrawals from their accounts. This can be particularly useful for those who are investing or trading and want to ensure that they receive their profits or returns on a regular basis without having to request a withdrawal each time manually. It provides convenience, and efficiency and saves precious time for the clients.

- VPS (Virtual Private Server): LiteFinance offers VPS services, providing clients with a private server that they can use for their trading activities. A VPS can provide a more stable and secure environment for online trading. It allows for faster execution of trades, reduces the chance of system downtime, and allows clients to trade 24/7, even if their own computer is switched off.

- Forecasts for Quotes: This service provides clients with predictions or forecasts for future financial market quotes. These forecasts can be based on various factors such as historical data, current market trends, economic indicators, etc. This information can be vital for traders and investors in making informed decisions about buying or selling securities and other financial instruments. It can potentially help in maximizing profit and minimizing losses.

These additional services by LiteFinance broker not only enhance the customer experience but also provide them with tools and information that could potentially increase their profitability in the financial markets.

Is LiteFinance Legal in Turkey?

LiteFinance, a renowned financial platform, is legally recognized and permitted to operate in Turkey. This implies that individuals and businesses in Turkey can utilize the services offered by LiteFinance, including trading, investing, and accessing financial resources and tools. The platform adheres to the financial regulations and standards set by the Turkish government, ensuring secure and responsible financial transactions. Thus, users in Turkey can confidently engage with LiteFinance broker, knowing their country’s laws protect them.

Is LiteFinance safe to trade with?

LiteFinance forex is considered safe and reliable in Turkey. It operates under strict regulations and security measures, ensuring the safety of its clients’ investments and personal information. Turkish users can trust LiteFinance due to its transparency, as it provides detailed information about its operations and adheres to the country’s financial regulations. The robust security protocols in place protect against unauthorized access and cyber threats, further enhancing its credibility. Therefore, LiteFinance is not only safe but also a dependable choice for financial services in Turkey.

LiteFinance Review Turkey – Conclusion

In conclusion, LiteFinance has established itself as a reliable forex broker in Turkey, offering a range of financial instruments and trading platforms to its clients. It ensures secure and efficient trading with its advanced technology and strong regulatory framework. The broker also provides comprehensive customer support and educational resources for both novice and experienced traders. However, the choice of a forex broker should ultimately depend on individual trading needs and goals. Therefore, potential clients are advised to thoroughly research and compare different brokers before making a final decision.